The answer is .. nothing. The bills kept coming, and even though he was paying the minimum payment, the debt was growing because, well, ya gotta live, right?

And having that second, third and fourth card meant that he was covered even when one of them maxed out.

So he did nothing, and waited for a business boom, a new job, a big lottery ticket or a trip to Las Vegas. And even if he didn't, and was keeping pace with those minimums with his job or business, he was still on a pace to give sick amounts of interest to the credit co.

That's just the math when paying the minimums, especially on multiple cards.

They will do something! And there are a lot of somethings they can do, some better than others. We'll share some of them, but there is a shortcut to all this that the Smartest people understand.

It is a rule of Getting Things Done. It is a Mindset. It is:

Suppose your ancestor buried a treasure somewhere, and you are in pursuit of it. There are secret caves to crawl through, passageways, drilling required as well as navigating a treacherous, piranha infested river.

But the ancestor left you a map. You know where to go. Only problem, you're not the best at spelunking (love that word for crawling through caves), aren't a strong driller, and can't really swim so well or handle class 5 rapids.

Suppose there's a local guide who zooms across the terrain together with a small team of drillers, cavers, kayakers and treasure finders.

Wouldn't it make sense to hire them to take you there? The four main methods of debt-ending - consolidation, management, settlement or dispute - are complicated and full of potential hazards. Wouldn't it make sense to speak to an expert guide, with teams in place to go with you to solve it?

.. they all provide a free conversation to plan how you will get out of debt. ADE, for example, provides unlimited debt help for as long as you need. Click here for details.

How can they do that? They earn their living from the program that they will enroll you in, so it's a win-win. You get your debt resolved, and they earn by connecting you to the perfect experts.

And what are the possible programs? Here are the main four.

Get out of your debt challenge with Debt Consolidation, and if you have multiple credit cards that are still not in collections, and you have a reasonable credit score, a consolidation loan is the best solution.

You take out a loan, repay all the credit cards, close the unnecessary ones and then just repay the loan on a fixed schedule. The interest is waaay less, you save lots of money and your credit score shoots up! It's a winner way.

You can do this yourself, or, again, work with an expert to get the best deal.

This is called Debt Management, and it's similar to Consolidation, except you work with a DMP company, rather than a bank. They take over your credit card debts, renegotiate with the companies, and take care of paying the new payments. You pay the DMP company.

It's also a huge money-saver, and will boost your credit in the long term, although there will be a slight hit when you start.

For this, you need to work with a professional.

If you are not yet in collections, but have started missing payments due to inability to cover them, then Debt Settlement and Renegotiation may be the best option.

Basically, the credit card company can sense when someone is in trouble and will be willing to get what they can. When they see missed payments on credit card accounts, they get worried.

They hate selling off debts to collectors, because they get very little.

So they will be willing to settle for more than they'd get from a collection agency, although a lot less than you have owed. This option becomes possible when you've missed about three months of payments.

Now, this is a legal negotiation, so here, too, having a qualified professional with you is crucial. Don't try this at home (unless you have the know-how and experience).

Smart people take action, because with debt, time really is money. The smartest people find other smart people with expertise, devotion and connections to work with them to get it done.

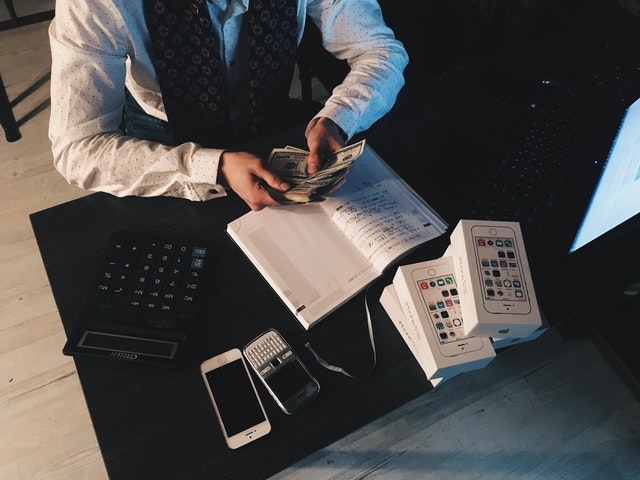

At crazy interest rates, every day you wait on your debt is costing you money. You might as well take some bills out to the trash every morning. Why??

Available by phone at 1-866-951-2987 from 9 AM to 8 PM Eastern time. To be eligible you must have $10,000 or more in debt and be able to pay $200/month.

CuraDebt does not operate in the following US states: CT, DE, GA, HI, ID, KS, KY, LA, ME, MT, ND, NH, NJ, NV, OH, OR, PA, PR, RI, SC, TN, UT, VT, WV and WY.

Click here to get it done

NDR is the larger of the debt help companies with a strong reputation. To be eligible, you must be a US citizen with at least $10,000 in unsecured debt. NDR cannot provide services for these states: CT KS ME NH SC OR VT WV.

Click here to get it done